Trick TAKEAWAYSAccording to the federal Centers for Condition Control as well as Avoidance, the worst age for mishaps is 16. If the student prepares to leave a car at residence as well as the college is even more than 100 miles away, the university trainee can qualify for a "resident student" price cut or a pupil "away" price cut (car insurance).

This is called a called exemption. IN THIS ARTICLEHow much is car insurance for teenagers? Like we've said, teen automobile insurance policy is pricey. The more youthful the vehicle driver, the much more pricey the auto insurance policy - cars. Youthful chauffeurs are much extra most likely to obtain into cars and truck accidents than older chauffeurs. The threat is highest possible with 16-year-olds, that have a collision rate twice as high as 18- and also 19-year-olds.

cars credit auto insurance credit score

cars credit auto insurance credit score

A study by the IIHS found states with more powerful graduated licensing programs had a 30% lower fatal accident price for 15- to 17-year olds. Including a teen to your automobile insurance coverage, Adding a young adult to your car insurance plan is the least expensive method to get your teenager guaranteed. It still comes with a substantial cost, but you can absolutely save if you choose the best cars and truck insurer for teenagers.

money liability affordable perks

money liability affordable perks

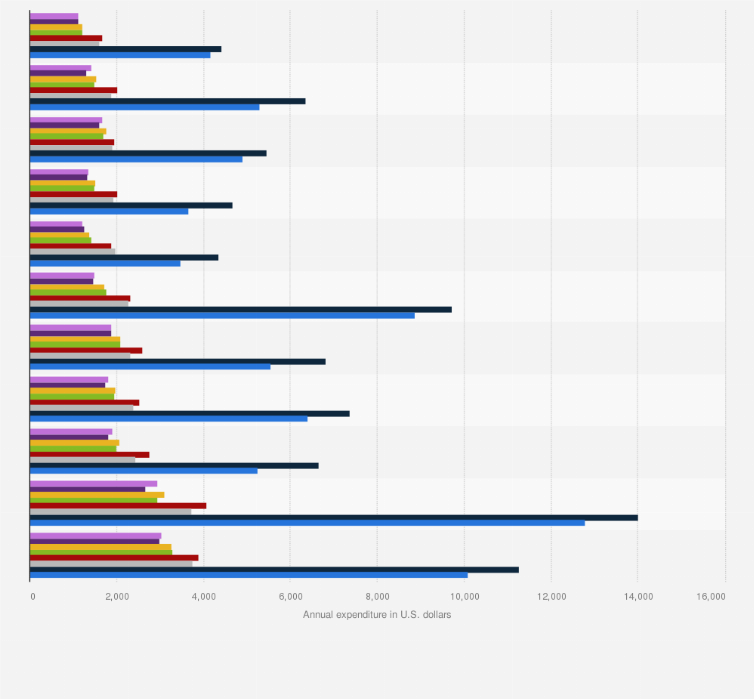

Then we included a 16-year old teenager to the plan. Below's what took place: The average family's automobile insurance coverage costs rose 152%. A teen child was much more pricey. The average expense rose 176%, compared to 129% for teen ladies. The golden state rates raised one of the most, greater than 200%. The reason behind the hikes: Teens accident at a much higher rate than older vehicle drivers.

They have an accident price twice as high as chauffeurs that are 18- and also 19-year-olds. Costs differ by insurance business, which is the reason we recommend purchasing for teen vehicle driver insurance.

Indicators on #1 Best Car Insurance On A Mustang For An 18-year-old (+ ... You Need To Know

Simply make certain your teenager isn't driving on a full license without being officially included to your plan or their own. That would be high-risk - car. If my teenager obtains a ticket, will it increase my prices?. As soon as with each other on the same policy, all driving documents-- including your teenager's-- influence costs, for better or worse.

To recognize exactly how a relocating offense will certainly impact your prices, we ran a research study and discovered that the added expense could range from 5% to as high as 20%. Can a teen get their own cars and truck insurance coverage policy? Companies will offer straight to teens. State laws differ when it comes to a teen's capacity to authorize for insurance policy.

As a matter of fact, your teenager will likely have a higher costs contrasted to including a teenager to a moms and dad or guardian plan. However, there are situations where it could make good sense for a teen to have their very own policy. Dynamic mentions two: You have a luxury cars. On a solitary plan, all motorists, consisting of the teen, are guaranteed against all autos.

Teenagers pay more for car insurance than grown-up drivers because insurance carriers consider them high-risk. There are means teen motorists can save on their auto insurance coverage costs.

Evaluate against the truth that young drivers are more most likely to get right into mishaps. You can also go down extensive and crash coverage if the vehicle isn't financed as well as not worth a lot.

Fascination About Car Insurance For 18-year-olds - Bankrate

An automobile with a high security score will be less costly to insure. This isn't really a popular choice for an anxious teen vehicle driver, yet it's worth thinking about.

Nevertheless, you should additionally understand the insurance firm still bill higher prices for the initial couple of years of the license. One more means to minimize your insurance coverage premium is to make use yourself of the price cuts offered. Several of them are pointed out below, Price cuts for teen motorists, We have actually identified the finest price cuts for teen chauffeurs to obtain affordable auto insurance.

That's $361 generally. You can take extra driver education and learning or a protective driving program. This implies exceed and beyond the minimum state-mandated motorists' education as well as training. In some states, discounts can run from 10% to 15% for taking a state-approved chauffeur renovation class. Online classes are a convenient choice however contact your provider initially to make certain it will lead to a discount rate (car insurance).

The average trainee away at college price cut is even more than 14%, which is a financial savings of $404. This suggests you do not obtain into any kind of crashes or offenses.

A number of vehicle insurer offer discounts if you enable a telematics gadget to be positioned in your automobile so they can monitor your driving routines (risks). This is thought about "pay-as-you-drive." This can quit to a 45% discount. With pay-per-mile, you'll pay for the range you drive, instead of driving patterns.

Our What Is The Cheapest Auto Insurance Rate For An 18-year-old ... Statements

There is possible to save. If the student intends to leave a cars and truck in the house as well as the college is more than 100 miles away, the university student can qualify for a "resident pupil" discount or a trainee "away" price cut, as discussed over. These price cuts can reach as high as 30%.

Both discounts will certainly need you to call your insurance coverage company so they can start to apply the discount rates. Learner's permit insurance coverage, You can get insurance coverage with a license, but the majority of vehicle insurance firms include the allowed teen on the moms and dads' plan without any type of action.

When that time comes, make sure to go to the rest of this post for support on alternatives and price cuts. It might be sensible to contact your insurance coverage company for all options available to you. Select no protection financial savings alternative, It's possible to tell your insurer not to cover your teenager, yet it's not an offered.

With a recommendation to your policy, you as well as your insurer mutually concur that the motorist isn't covered, which means neither is any kind of mishap the motorist triggers. Not all business allow this, and not all state do either. car insured. Adding a teen vehicle driver rip off sheet, Speak with your service provider as soon as your teenager gets a chauffeur's certificate.

Talk to your teenager early and also frequently about security. Insist they drive a risk-free automobile. Things to think about before selecting an auto insurance policy firm for your teenager Possibilities are that your vehicle insurance coverage business will call you.

The smart Trick of Car Insurance For 18-year-olds - Moneysupermarket That Nobody is Talking About

Often asked inquiries regarding teen insurance policy, Do you need to add a teenage motorist to your insurance? Yes, you'll have to add your young adult to your car insurance coverage if they live with you and drive your vehicle. trucks. Some states will certainly require you to add your teenager chauffeur as an additional insured person when they obtain their student's authorization.

Should I add my 16-year-old to auto insurance? The majority of states require you to add your 16-year-old teenager to your cars and truck insurance policy as soon as they obtain their certificate.

Even if it is not required, it's constantly a great idea to ensure you're covered by automobile insurance coverage. Just how to obtain automobile insurance coverage for a teen? It is feasible for a young adult to get automobile insurance policy with a permit, however the majority of insurance carriers will certainly include the permitted teen on their parent's plan with no various other formalities. car.

Just how much does it set you back to add a 17-year-old to cars and truck insurance policy? The ordinary car insurance expense for a 17-year-old for complete protection is $5,836 a year - dui. Your Visit this page vehicle insurance coverage price will certainly rely on where you live, the protection level you pick, the make and version of your auto, among other variables.

Something went wrong. Wait a minute as well as attempt again Try again.

About Cheap Car Insurance For An 18 Year Old : R/personalfinance

According to the Centers for Condition Control and Avoidance, drivers ages 15 to 19 are four times more likely to collapse than older chauffeurs, making cars and truck accidents the No. 1 cause of fatality for teenagers. suvs. Even teenagers with clean mishap records will certainly deal with high auto insurance rates for a number of years as a result of their lack of driving experience.

, but getting a vehicle for the teenager as well as putting him on his own plan isn't one of them. Contrast that to an ordinary price rise of $621 for including a teen to the moms and dads' policy that implies you'll pay 365 percent a lot more by putting the teen on his or her very own plan.

But the finest means to hold rates down is to see to it your teen maintains a clean driving record. Adding a teen to your insurance coverage plan will certainly no uncertainty raise your prices, but there are points you can do to balance out the new costs and lower your automobile expenditures.

According to, young male drivers are virtually triple the price of young women vehicle drivers, who get on average 2,902 deaths compared to 1,024 - low-cost auto insurance. Resource link Furthermore, Insurify performed a study of thousands of countless quotes for teen vehicle drivers to identify the ordinary month-to-month cost of auto insurance, as well as they located that the prices were greater than the average for all various other united state

The average costs increased 60% for women age 19 vs. Resource URL The average complete coverage automobile insurance rate for a 20-year-old male has to do with $3,600. A plan that satisfies the state minimum needs to drive prices regarding $1,220. Resource link Price for All 19 years-olds If you're a 19-year-old, you pay high rates for automobile insurance policy - cheapest car insurance.

The average expense of complete insurance coverage for a 19-year-old motorist is $3,560, which is greater than $1,800 greater than the national standard for drivers age 30. cheaper auto insurance. This is because of the reality that they are unskilled and have a high price of accidents. Resource URL, Source link Why is Car Insurance Coverage So Costly for 19-year-olds? Auto insurance policy prices vary depending upon a number of group information.

The various other factors that commonly impact costs are: Marital condition, Area, Gender, Credit rating, Driving history, Lorry make as well as design Insurance policy for a 19-year-old is usually expensive, not only due to the fact that of the vehicle driver's age yet various other factors that likely apply to young adults.